How We Paid Off Over $40,000 in Debt!: The Best Budget Tool EVER!

I know, I know. You want some sort of magic bullet that will miraculously vanish your debt. I don’t think there is anything like that out there. So you are left with a budget and that’s how we did it. We used the best budget tool for us and got it done.

Like most people, we got out of college with a lot of debt, both student loan and credit card. We didn’t control our spending much in college because we thought that we would get out of college, get an amazing job that paid very well, and we would be ballin and able to pay everything off really quickly. Well, reality hit pretty fast.

We found ourselves newly married and with a lot of debt. Research says that money issues are responsible for 22% of divorces which is the 3rd leading cause. Also that for couples having any relationship issues, the number one cause of the issues (35%) is finances. So it can be a very stressful situation for a newly married couple.

Some people choose to deal with it by having separate accounts or each person handling their own bills. But we truly felt that if what God said about marriage is true (“that a man should leave his mother and father and be joined to his wife” – Ephesians 5:31), then we needed to be joined not only physically but in every way including our finances.

Tips for Married Couples

1. Be on the Same Page

When you come into a marriage there is lots of love, but there are also a lot of things you have to figure out and learn. Finances should be one of the first things that you talk about (if you haven’t talked about them before you got married). You should talk about what your goals are as a family. Speaking of family, when are you going to start having a family (it shouldn’t be just a question your mother asks)? Because with that comes with some decisions about money in and of itself. Or do you plan on traveling first? If so how many trips do you want to take a year? Do you have debt that you need to pay off?

All of these questions are going to lead back to one thing, how are we going to pay for it. There is really no wrong answer. No matter what you decide, make the decision together and get on the same page. Then start using the best budget tool for you.

2. Choose One Person to Be the Primary Budget Manager

There is usually one person in every relationship that is better at managing money than the other. One person is better with numbers or just a bit more disciplined with their spending. That is the person that should be the primary manager of the budget. It just kinda makes sense, the best person for the best budget tool. This person will be the one that takes into account the bills and expenses when allocating money and keeping track of the spending. But that does not mean the other person can do whatever they want and has no responsibility when it comes to the money. Which brings me to the next tip.

3. Switch Roles for a Bit

Inevitably, you will hit some hard patches even if you are the most amazing couple ever. One person will buy something outside of the budget, one person will be too controlling with the money, or one person just might not understand the whole budget thing.

With my husband and I, one of us just liked to spend more than the other. They did not understand how that extra spending threw off the rest of the budget or even worse messed up the bills (late fees anyone?) Which is why I recommend that once you have been doing a budget for a while, switch roles. Let the budget manager, off the hook. Let the spender or less money disciplined person take over the budget.

It teaches both persons that, they have to work together. You can’t be so focused on the numbers that you forget your spouses needs and wants. But you also can’t be so focused on what you want that you forget the common goal. (You did set one right?)

General Budgeting Tips

- The most important tip is that you should sit down with your spouse each pay period and work on the budget. You need to ask if there are any expenses that the other person will have that pay period. Is the car registration due? Do you need a haircut? Does the car need a repair? You know the saying two heads are better than one. If you both work on the budget, it is less likely that you will forget something and blow your budget.

- Make sure you allocate all your money every pay period. You tell your money where to go. You have to be in control.

- Budget the most important things first. No, you can’t go get your nails done and forget about the electric bill. So that means, housing, food, utilities come first.

- If you have debt, you gotta pay it off. It is amazing how much more money you have to save or to spend on vacations when you don’t have to worry about a credit card bill, student loans, or a car payment. We used Dave Ramsey’s Baby Steps and Debt Snowball Method. There are others out there. Find what works for you.

- You may have heard of the saying, “there is more week than there is money.” If you run out of money before you run out of budget items, then you gotta cut back on somethings. We haven’t had cable in over 10 years. We love Netflix! Or you may need to see how often you go out to eat. Restaurants can do a number on your budget.

- Allocate a little bit of money for miscellaneous items. A blown tire or the unexpected flu can derail even the most well thought out budget no matter if you are using the best budget tool ever.

- Finally, review your budget often. You may realize you don’t budget enough for gas each pay period. Or that you have been able to cut going out to eat and don’t need as much budgeted for that. (Yeah!)

The Best Budget Tool Ever

There are lots of programs, apps, and tools that you can use to make a budget. They can be as simple as a pad and pen to as complex as money management software as Quicken.

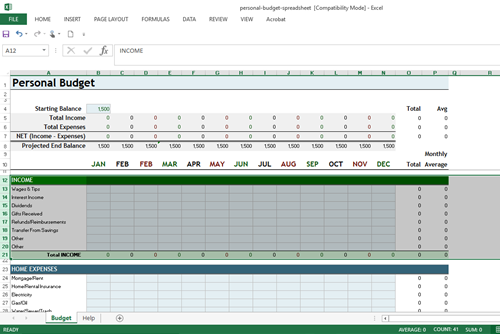

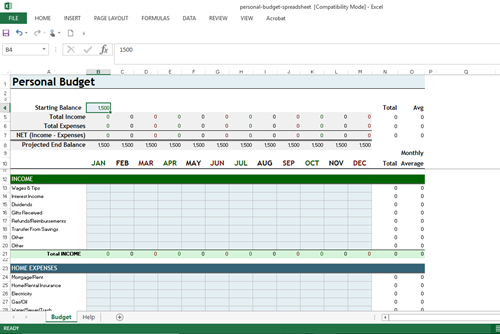

I have tried a lot of different things. Mint.com, YNAB (www.youneedabudget.com), Quicken, Everydollar, and the good old paper and pen method. But the tool that has worked best for our family is a Personal Budget Spreadsheet on Excel.

How to Use the Personal Budget Spreadsheet

Customize the Spreadsheet

Why I think that this is the best budget tool our there is because you can completely customize the spreadsheet to fit your needs and situation.

A. Review Column A, Row 13-20 – Enter all the income that you get. (Paychecks, Child Support)

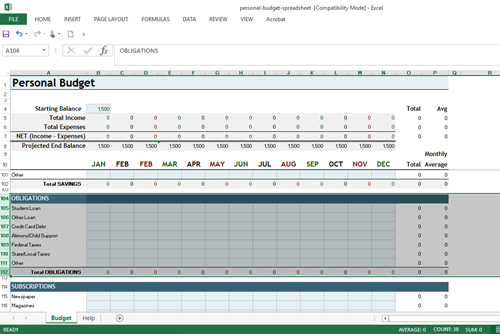

B. Review Column A, Rows 23-125 – Enter each of your expenses in their proper category. Add due dates for your bills so you know when each come out of your account.

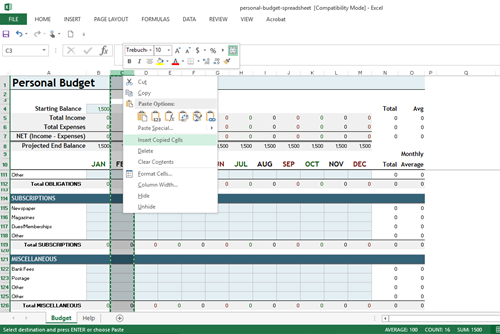

C. Review Row 10 – The spreadsheet is set up for Monthly Paychecks. But we were paid every 2 weeks. So I added a column for each paycheck that we received. (Select Column, Press Ctrl+C, right-click, select insert copied cells). Repeat this step as many times as you need to add the number of columns you need for each pay period.

D. Review Rows 104-111 – The spreadsheet has one spot for credit card debt. I did not want to have it all clumped together. So I added a line for each of our debt. I also included the due date and the balance. Enter each of your debts in these rows.

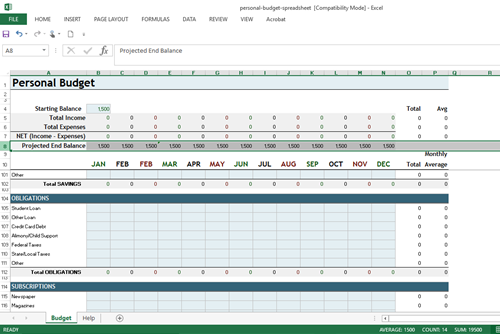

E. Enter the current balance in your checking account in Cell B4.

Now you are all ready to start working on your budget each pay period.

What to do Each Pay Period

A. Fill out the income section first.

B. Enter your expenses for that pay period. Don’t forget about “special” expenses like birthdays or insurance that are not normal everyday expenses, but only come around once or twice a year.

C. Allocate your spending categories- Going out to eat, gas, groceries etcetera. You can then use cash for these items (Dave Ramsey’s recommendations and what I recommend when you are first starting out) or you MUST be vigilant about keeping track of your spending by sitting down every few days and calculating what you have left for each category.

D. Your job is to make sure that Row 8 for each pay period is as close to zero as possible (all of your money is allocated).

And that’s it. Now you have the best budget tool every so go stick to the budget. It is not for the faint of heart, it will take some discipline and consistency! Download your copy of the Personal Budget Spreadsheet and you will be on your way to being debt free and reaching your financial goals.

What are your biggest struggles with sticking to a budget?

Responses